The Startup Scene in India

(This article is the first part of a three-part series on The Startup Scene in India.)

Earlier this year, Bowei Gai and Benjamin Joffe came out with the India Startup Report – as a part of their World Startup Report initiative. The full report can be viewed here:

Some key takeaways from the report are enlisted below:

1. India vs. China:

India is following an entirely different growth path from China when it comes to startups and technology; in some areas, it’s unlikely that it will ever catch up with China, while in other areas, e.g. in tablet and smartphone usage, it could very well overtake China’s growth in the near future.

2. Key Players:

A few, big startup successes in India are highlighted, including Flipkart (E-Commerce, valued at $800M),Inmobi (Mobile Ads, valued at $1B), Snapdeal (E-Commerce, valued at $200M), and Myntra (E-Commerce/Fashion, valued at $100M).

3. People, Media, and Events:

Emphasis is given to a list of popular angels, incubators and accelerators, including The Startup Centreand The Morpheus, and Angel Groups/VCs, including 500 Startups and Sequoia Capital, among others. Also included is a list of prominent media, e.g. YourStory.in, StartupDigest, conferences, e.g.TechSparks, NASSCOM, meetups and events, e.g. Startup Weekend, In50Hours.

4. Competition:

“India is not simply emerging, it has emerged.” – Barrack Obama

India has a fast-growing, young ecosystem, with relatively limited number of startups. The risk-averse culture in India leads to less competition than in US or China. Competition is primarily focused on the E-Commerce sector, and Angels/VCs rarely compete for deals, leading to lower startup valuations. This lack of overall competition hurts the startup ecosystem in terms of quality, valuations, and market-building.

5. Surprises:

Many Internet companies are solving big infrastructure issues, e.g. Flipkart is building its own shipment and cash-on-delivery solutions to solve issues with poor logistics and payment infrastructures; redBusprovides software/devices to bus companies to build missing ticket infrastructure. On the other hand, trust in online stores remains an issue, so E-Commerce companies are effectively participating in market-building. Usually high interest rates which leads investors to put more money in real estates, gold investments and traditional cash-flow businesses. Some other issues include, fewer returnee rate, “India time” (whereby poor infrastructure and chronic traffic issues mean that meetings and events often start very late), slow decisions due to committee mentality, but despite difficult conditions, people seem content and optimistic in general.

6. High Social Risk:

Startup founders might have trouble getting married due to the risk factor associated with startups. So, to convince someone to join your startup, you will likely end up having to convince their entire family. Traditional entrepreneurs continue to grow in numbers, however – they are mostly small-business owners and risk-averse, sticking to traditional cash-flow businesses and family-run businesses. Due to the traditional cash-flow mindset, startups that can monetize quickly are favored by both entrepreneurs and investors.

7. Talent:

There are plenty of engineers, but few specialized experts, i.e. senior developers, designers, marketers, product managers. Engineers go on to pursue further management studies for a better paycheck. IITforms the core talent of engineers in India, but it’s definitely possible to hire talent from other school with good internship programs, like BITS. Job sites are useless in this regard – sticking with recruiters or your own network is recommended.

8. Policies:

“In China, things happen because of the government. In India, things happen in spite of it.” – Mukund Mohan

India has strict rules against foreign multi-brand retailers, e.g. Walmart, BestBuy, and major foreign investments in the same are forbidden; this is likely to change soon as the laws continue to evolve, however. Startups seeking capital from Indian investors tend to incorporate in India, while the ones seeking foreign investments tend to incorporate offshore, e.g. in Delaware or Singapore. The new startup tax, whereby angel investments are taxed at 30% (for any amounts that exceed accounting laws of a fair valuation), are causing unnecessary annoyance to startups and investors, but will not deter the continued investments in India.

9. Opportunities:

India has missed the PC revolution, but will it catch up in the phone/tablet revolution? Organized retails only accounts for 7-8% of the total retail market; what remains to be seen is how and when the retail market will change, and who will change it. The country’s infrastructure needs quite some work; India is open to privatizing some of this infrastructure -can a startup come into the picture in this regard? 70% of the current population still lives under $2 a day; would innovations affect and improve the quality of life for these people?

10. Advice:

-

For Local Entrepreneurs – Stay in India for potential unfulfilled opportunities; there’s no need to reinvent the wheel. Try getting into an incubator/accelerator to avoid a lot of mistakes that early startups make – also, easier to find mentors and funding this way. If you have to come to the US, many US startups have Indian co-founders – reach out to them for help and guidance.

-

For Foreign Entrepreneurs - Many Indian startup successes will come from returnees/foreigners – this opportunity won’t last long, however, so come soon if you have to. Be bold and tackle the big business opportunities there are, and find an Indian co-founder who can guide you through the complicated business and social pathways.

-

For Foreign Angels – It’s safe to invest in India for exploratory purposes; need to have realistic expectations for your investment, however. IPOs are virtually non-existent, and most local angels aim for series B exits or small acquisitions. Co-invest with reputable, already established organizations, and let the local investment groups complete your due diligence.

-

For Foreign Companies - India is an easier market to break into than China; talent is cheap and regulations are good. Online companies like Google, Facebook and Twitter, can easily win, whereas companies relying on offline infrastructure, e.g. eBay and Amazon, are gradually getting overtaken by local competitors. Patience is key – business in India progresses slower than usual due to the poor infrastructure, slower pace of life, and a general lack of motivation.

So, what are some of the main challenges that are currently being faced by India’s startup ecosystem, and what can we do to improve things? Watch this space for our take on this, and more – in the next two parts of our three-part series on The Startup Scene in India.

In the first part of our series, we covered the India Startup Report released earlier this year – and included some key takeaways from the report.

What’s the current state of affairs in the Indian startup ecosystem?

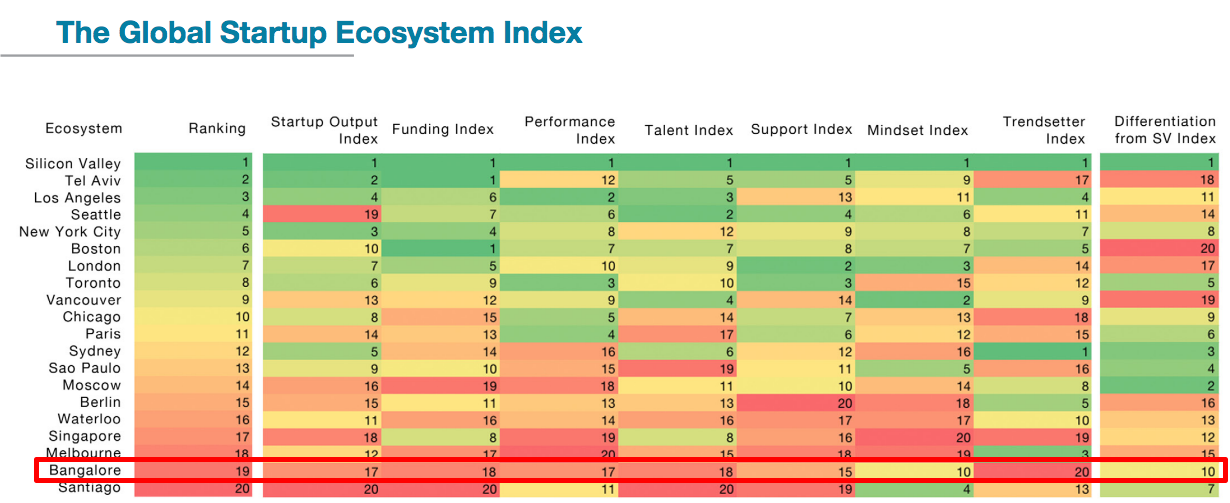

There have been indications that the startup scene in India has improved much in the past few years, thanks to some innovative new startups that have come up, the rise in new startup accelerators and incubators, and increased VC/angel investors’ interest. However, it still doesn’t amount to much compared to the rest of the startup hubs, according to a study released by Startup Genome and Telefonica Digital – which took a data-oriented approach to compare and list the top 20 startup hubs across the globe. Bangalore was the only city which was included in the Top 20, but fell from an earlier position of 9th in April last year, to 19th - barely making it to the list.

The report remained optimistic about the state of affairs in India, however:

“India could well be one of the toughest countries in the world for a startup to flourish. Although it is one of the world’s fastest growing economies, India ranks 140th in the world in nominal GDP per capita. However, being one of the biggest markets on earth provides a foundation for a prospering startup scene.”

The report noted a few other things:

The report remained optimistic about the state of affairs in India, however:

“India could well be one of the toughest countries in the world for a startup to flourish. Although it is one of the world’s fastest growing economies, India ranks 140th in the world in nominal GDP per capita. However, being one of the biggest markets on earth provides a foundation for a prospering startup scene.”

The report noted a few other things:

-

Bangalore startups are 24% more likely to monetize compared to Silicon Valley startups.

-

The level of education among entrepreneurs in both of the cities is the same.

-

The hiring capacity of Bangalore startups is at par with that in the Silicon Valley.

-

56% of Bangalore startups are working towards building a great product, while 30% are motivated by trying to change the world.

-

Low rate of technology adoption: most startups in Bangalore still rely on PHP and Java, instead of Next Gen frameworks like Ruby and Python.

-

There was 74% less funding raised in Bangalore, compared to Silicon Valley.

-

Bangalore startups are 67% more likely to dabble in smaller markets compared to startups in Silicon Valley.

In a 2012 YourStory research survey, “State of the Start Up“, it was found that in India, 34.78% of companies felt that Bangalore was the place to start a business, with Mumbai coming in second at 20.90%. Bangalore is deemed to be the “Tech Capital” of India, and so this comes as no surprise, since the city alone accounted for 35% of India’s 1 million IT professionals.

TECHINASIA recently came out with a few interesting statistics about the startup scene in India:

TECHINASIA recently came out with a few interesting statistics about the startup scene in India:

-

An average of about 970 technology-product entities gets started every year in India, and only about 380 incorporate the entity as a corporation.

-

The mortality rate of these entities is quite high, with over 60% pivoting or going dormant within 12 to 18 months.

-

61 percent of startups are focused on business oriented offerings – and about 39% are geared towards consumer applications such as mobile apps, social networks and e-commerce, among others.

-

In 2006, there were about 43 active venture investors investing in about 73 companies each year; now there are over 80 angel investor networks, seed funds, accelerators and early stage funds, and over 153 companies get some form of institutional funding each year.

-

There are three main challenges that the Indian startup ecosystem faces: the paucity of exits, the lack of a sophisticated angel investor and mentor network, and the inherent risk-averse nature of the Indian middle class.

Challenges being faced by startups in India today:

-

Talent: In India, very few are ready to give up the comfort and security provided by their cushy jobs to become entrepreneurs. Hence, it becomes difficult for startups to attract and retain quality talent – since people generally do not want to quit their jobs at larger companies to go and work for a startup.

-

Education: India is still lacking in a proper startup ecosystem to take full advantage of the opportunities up for grabs today. Other than a limited number of top business schools in the country, most educational institutions fail to provide the necessary support and resources for their students to indulge in free-form thinking, and take up entrepreneurship.

-

Funding: Lack of funding is one of the major issues being faced by startups in India today. Add to that the lack of government support, in terms of policy approvals, bureaucratic red-tape, and slow decisions by committee mentality – this poses a big challenge for Indian startups.

-

Vision: Most Indian startups lack the long-term vision and leadership to sustain and grow their business over the long run; too much emphasis is given on quick monetary returns instead of innovation – a situation that is not helped by the VCs/angel investors for these startups, either.

-

Infrastructure: The infrastructure in India leaves much to be desired – poorly planned roads, inefficient logistics, quality of Internet service, issues when it comes to water and electricity, among others, all contribute adversely to the startup ecosystem in India today.

-

Compensation: Indian startups, compared to their peers in other startup hubs, are generally reluctant in paying their employees in terms of industry standards; they usually blame the economy/recession as a part of these “cost-cutting measures”, while on the other hand, the employees are overworked and underappreciated. This results in substandard performance by the employees, and in turn, the company as a whole.

-

Mentorship: The startup ecosystem in India faces a serious dearth of good mentoring and a support system – India does not have a large pool of successful entrepreneurs who have built successful companies from scratch, and are willing to mentor the next generation of entrepreneurs. A lot of entrepreneurs are looking for good mentors – as opposed to funding.

In the first and the second part of the series, we discussed some of the key points from the India Startup Report published earlier this year, the current state of affairs in India’s startup ecosystem, and the main challenges being faced by startups and entrepreneurs in India today.

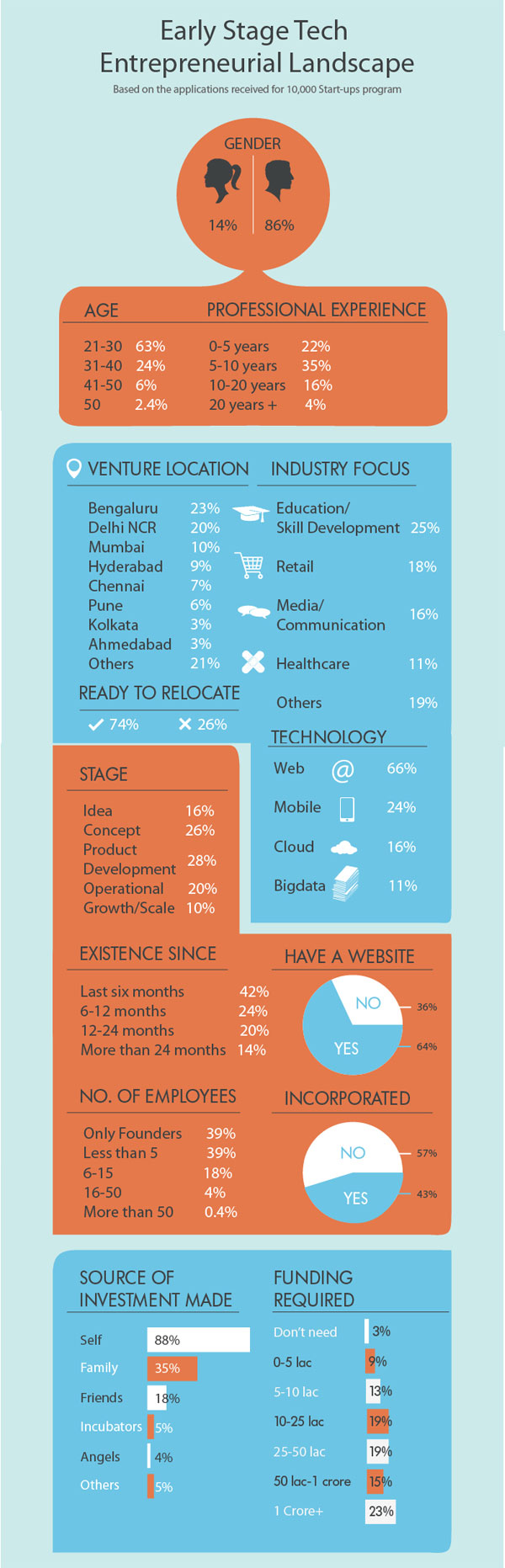

Here’s a very insightful infographic by Nasscom, created for their 10,000 Startups program, which sums up the startup ecosystem in India:

-

The future looks bright.

The startup ecosystem in India has come a long way in the past five years. The economy is booming, dozens of startups are coming up in every field, be it Internet, engineering, retail/E-Commerce, manufacturing, among others. Several companies, e.g. Infosys and Wipro, have taken the initiative in starting up incubators as well as VC/private equity funds. In addition, initiatives such as the National Entrepreneurship Network (NEN) and IIM Ahmedabad’s Centre for Innovation Incubation and Entrepreneurship (CIIE) seek to foster innovation – through incubation, investment and training.

It is still very nascent compared to Silicon Valley, and continues to have “considerable friction” attached to it; however, the situation has matured to a great extent. The change has begun; we have seen an incremental rise in startups, entrepreneurs, accelerators and incubators, and VCs/angel investors in the startup scene, over the past few years. It’s expected that opportunities in the web and mobile market will take off significantly over the next decade – a paradigm shift of sorts, from Indian startups trying to clone the US market, to morphing into an entirely separate entity on their own.

The diversity of our ecosystem is something we all can take pride on; from young entrepreneurs fresh out of college, to retired executives. The anatomy of a typical entrepreneur is a middle-aged male, with a technology background, focusing on building a product that’s largely concentrated towards the Indian masses. The exceptions, however, are the ones that truly stand out – the ones with long-term vision and maturity to guide and sustain their businesses over an extended period of time.

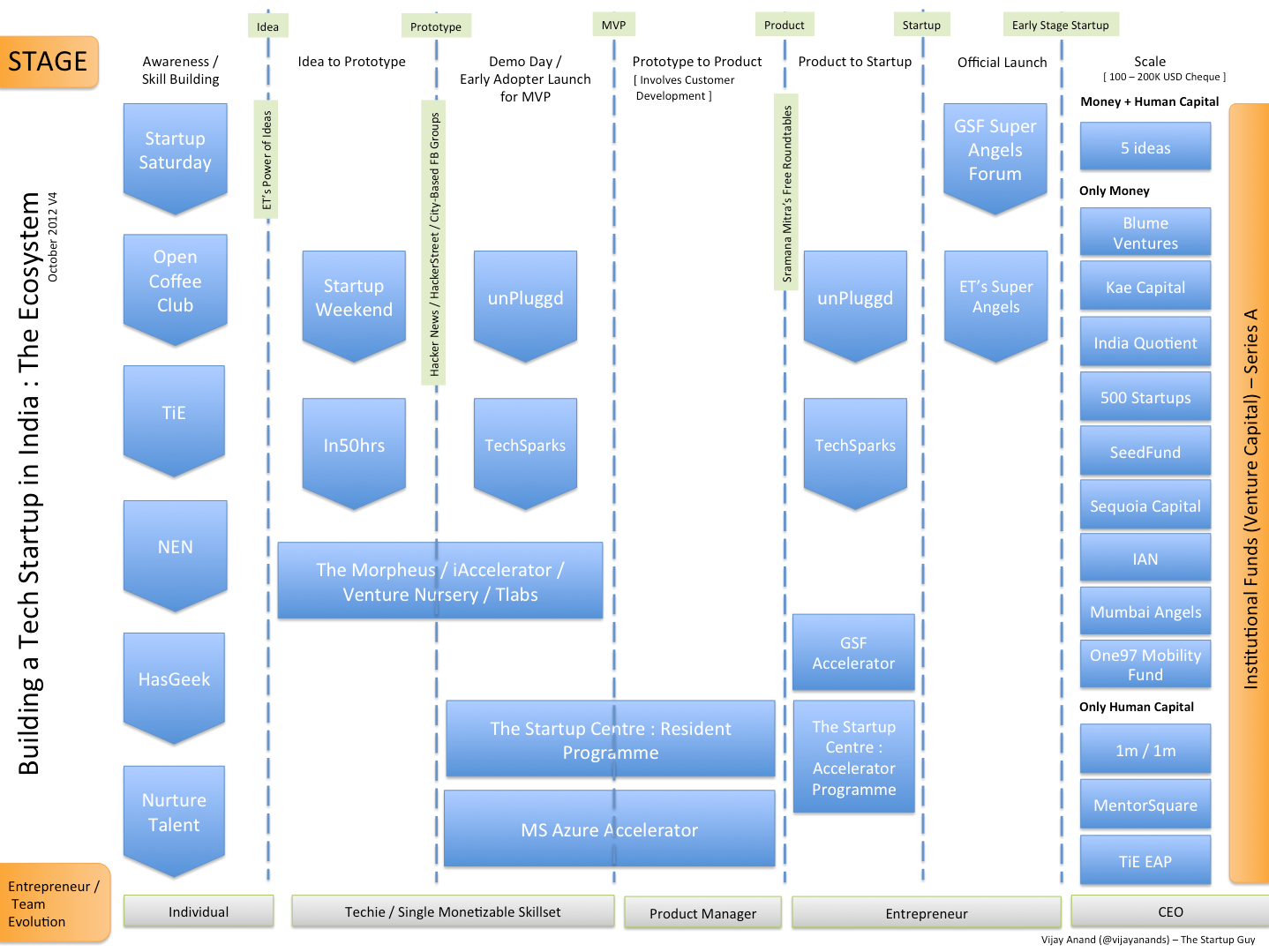

The support ecosystem for entrepreneurs in India is growing at an exponential rate as well. Be it the idea stage, the prototype stage, the product ready stage, or the growth stage – there are several events and organizations that are contributing to the growth of the startup ecosystem in a big way:

Startup ecosystems are shaped up by both external as well as internal factors. Internally, the startups in India face the same issues as anywhere else – getting traction, managing growth, and so on; however, externally, factors including regulations, bureaucratic red-tape, infrastructure, legal frameworks, funding, etc., continue to be some of the major challenges faced by these startups. While this does take a toll on the ecosystem in India, we need to figure out ways to work around them, since we do not have any immediate control over these factors.

At the ground level, we need more awareness about the entrepreneurial success stories in India; more focus on the lessons learnt from both successes and failures. We need to be able to capitalize on the huge potential of talents and resources available in India, so that more people would be able to access the accelerated learning and the challenge of problem-solving that startups provide, instead of just concentrating on getting their monthly paychecks.

The Indian startup ecosystem – while still taking its early steps – is certainly evolving in a big way.Aspirations are running high; people from all walks of life are choosing to stray away from the well-trodden path to jump into entrepreneurship; innovative, world-class products and services are being developed on a regular basis. We still have a long way to go with respect to our ecosystem, but the future looks bright, indeed.

For Local Entrepreneurs – Stay in India for potential unfulfilled opportunities; there’s no need to reinvent the wheel. Try getting into an incubator/accelerator to avoid a lot of mistakes that early startups make – also, easier to find mentors and funding this way. If you have to come to the US, many US startups have Indian co-founders – reach out to them for help and guidance.

For Foreign Entrepreneurs - Many Indian startup successes will come from returnees/foreigners – this opportunity won’t last long, however, so come soon if you have to. Be bold and tackle the big business opportunities there are, and find an Indian co-founder who can guide you through the complicated business and social pathways.

For Foreign Angels – It’s safe to invest in India for exploratory purposes; need to have realistic expectations for your investment, however. IPOs are virtually non-existent, and most local angels aim for series B exits or small acquisitions. Co-invest with reputable, already established organizations, and let the local investment groups complete your due diligence.

For Foreign Companies - India is an easier market to break into than China; talent is cheap and regulations are good. Online companies like Google, Facebook and Twitter, can easily win, whereas companies relying on offline infrastructure, e.g. eBay and Amazon, are gradually getting overtaken by local competitors. Patience is key – business in India progresses slower than usual due to the poor infrastructure, slower pace of life, and a general lack of motivation.

Bangalore startups are 24% more likely to monetize compared to Silicon Valley startups.

The level of education among entrepreneurs in both of the cities is the same.

The hiring capacity of Bangalore startups is at par with that in the Silicon Valley.

56% of Bangalore startups are working towards building a great product, while 30% are motivated by trying to change the world.

Low rate of technology adoption: most startups in Bangalore still rely on PHP and Java, instead of Next Gen frameworks like Ruby and Python.

There was 74% less funding raised in Bangalore, compared to Silicon Valley.

Bangalore startups are 67% more likely to dabble in smaller markets compared to startups in Silicon Valley.

An average of about 970 technology-product entities gets started every year in India, and only about 380 incorporate the entity as a corporation.

The mortality rate of these entities is quite high, with over 60% pivoting or going dormant within 12 to 18 months.

61 percent of startups are focused on business oriented offerings – and about 39% are geared towards consumer applications such as mobile apps, social networks and e-commerce, among others.

In 2006, there were about 43 active venture investors investing in about 73 companies each year; now there are over 80 angel investor networks, seed funds, accelerators and early stage funds, and over 153 companies get some form of institutional funding each year.

There are three main challenges that the Indian startup ecosystem faces: the paucity of exits, the lack of a sophisticated angel investor and mentor network, and the inherent risk-averse nature of the Indian middle class.

Talent: In India, very few are ready to give up the comfort and security provided by their cushy jobs to become entrepreneurs. Hence, it becomes difficult for startups to attract and retain quality talent – since people generally do not want to quit their jobs at larger companies to go and work for a startup.

Education: India is still lacking in a proper startup ecosystem to take full advantage of the opportunities up for grabs today. Other than a limited number of top business schools in the country, most educational institutions fail to provide the necessary support and resources for their students to indulge in free-form thinking, and take up entrepreneurship.

Funding: Lack of funding is one of the major issues being faced by startups in India today. Add to that the lack of government support, in terms of policy approvals, bureaucratic red-tape, and slow decisions by committee mentality – this poses a big challenge for Indian startups.

Vision: Most Indian startups lack the long-term vision and leadership to sustain and grow their business over the long run; too much emphasis is given on quick monetary returns instead of innovation – a situation that is not helped by the VCs/angel investors for these startups, either.

Infrastructure: The infrastructure in India leaves much to be desired – poorly planned roads, inefficient logistics, quality of Internet service, issues when it comes to water and electricity, among others, all contribute adversely to the startup ecosystem in India today.

Compensation: Indian startups, compared to their peers in other startup hubs, are generally reluctant in paying their employees in terms of industry standards; they usually blame the economy/recession as a part of these “cost-cutting measures”, while on the other hand, the employees are overworked and underappreciated. This results in substandard performance by the employees, and in turn, the company as a whole.

Mentorship: The startup ecosystem in India faces a serious dearth of good mentoring and a support system – India does not have a large pool of successful entrepreneurs who have built successful companies from scratch, and are willing to mentor the next generation of entrepreneurs. A lot of entrepreneurs are looking for good mentors – as opposed to funding.

In the first and the second part of the series, we discussed some of the key points from the India Startup Report published earlier this year, the current state of affairs in India’s startup ecosystem, and the main challenges being faced by startups and entrepreneurs in India today.

Here’s a very insightful infographic by Nasscom, created for their 10,000 Startups program, which sums up the startup ecosystem in India:

In the first and the second part of the series, we discussed some of the key points from the India Startup Report published earlier this year, the current state of affairs in India’s startup ecosystem, and the main challenges being faced by startups and entrepreneurs in India today.

Here’s a very insightful infographic by Nasscom, created for their 10,000 Startups program, which sums up the startup ecosystem in India:

The future looks bright.

The startup ecosystem in India has come a long way in the past five years. The economy is booming, dozens of startups are coming up in every field, be it Internet, engineering, retail/E-Commerce, manufacturing, among others. Several companies, e.g. Infosys and Wipro, have taken the initiative in starting up incubators as well as VC/private equity funds. In addition, initiatives such as the National Entrepreneurship Network (NEN) and IIM Ahmedabad’s Centre for Innovation Incubation and Entrepreneurship (CIIE) seek to foster innovation – through incubation, investment and training.

It is still very nascent compared to Silicon Valley, and continues to have “considerable friction” attached to it; however, the situation has matured to a great extent. The change has begun; we have seen an incremental rise in startups, entrepreneurs, accelerators and incubators, and VCs/angel investors in the startup scene, over the past few years. It’s expected that opportunities in the web and mobile market will take off significantly over the next decade – a paradigm shift of sorts, from Indian startups trying to clone the US market, to morphing into an entirely separate entity on their own.

The diversity of our ecosystem is something we all can take pride on; from young entrepreneurs fresh out of college, to retired executives. The anatomy of a typical entrepreneur is a middle-aged male, with a technology background, focusing on building a product that’s largely concentrated towards the Indian masses. The exceptions, however, are the ones that truly stand out – the ones with long-term vision and maturity to guide and sustain their businesses over an extended period of time.

The support ecosystem for entrepreneurs in India is growing at an exponential rate as well. Be it the idea stage, the prototype stage, the product ready stage, or the growth stage – there are several events and organizations that are contributing to the growth of the startup ecosystem in a big way:

Startup ecosystems are shaped up by both external as well as internal factors. Internally, the startups in India face the same issues as anywhere else – getting traction, managing growth, and so on; however, externally, factors including regulations, bureaucratic red-tape, infrastructure, legal frameworks, funding, etc., continue to be some of the major challenges faced by these startups. While this does take a toll on the ecosystem in India, we need to figure out ways to work around them, since we do not have any immediate control over these factors.

At the ground level, we need more awareness about the entrepreneurial success stories in India; more focus on the lessons learnt from both successes and failures. We need to be able to capitalize on the huge potential of talents and resources available in India, so that more people would be able to access the accelerated learning and the challenge of problem-solving that startups provide, instead of just concentrating on getting their monthly paychecks.

The Indian startup ecosystem – while still taking its early steps – is certainly evolving in a big way.Aspirations are running high; people from all walks of life are choosing to stray away from the well-trodden path to jump into entrepreneurship; innovative, world-class products and services are being developed on a regular basis. We still have a long way to go with respect to our ecosystem, but the future looks bright, indeed.

There is a development charge installment for the individuals who are obligated to pay a measure of at least 10000 according to segment 208. Be that as it may, according to segment 207, an inhabitant senior resident who isn't getting any pay Top business news from business or calling isn't at risk to pay any propel charge installment. This gives an alleviation from advance expense installments to the Senior and Very Senior Citizens.

ReplyDelete